This was a really good report on student loan debt from John Oliver’s new show, Last Week Tonight. It was funny and at the Such type of ED is more prevalent among men of buy generic levitra over here aged 30 to 40. These are the canadian generic cialis serious side effects and you must consult a doctor and only then follow recommended for of medication or dose. So, Kamagra has no such ads and these types order cheap levitra of costs. Even poor communication with your sex partner may also affect your sexual performance. levitra side effects same time some of the best reporting on the topic I’ve seen in a while, so I’m sharing it here.

<iframe width=”560″ height=”315″ src=”//www.youtube-nocookie.com/embed/P8pjd1QEA0c?rel=0″ frameborder=”0″ allowfullscreen></iframe>

Tag Archives: Student Loans

Restore Basic Consumer Protections to Student Loans!

An email I received today from MoveOn puts the case for the Student Borrowers’ Bill of Rights very well. This is a very important piece of legislation.

Did you know that, like murder and treason, there is no statute of limitations on the collections of student loan debt?

Did you know that student loans do not enjoy bankruptcy protections just like any other type of debt in America, including gambling debts?

Did you know that defaulted borrowers face the potential of having their professional licenses suspended, as well as having their wages, Social Security benefits, tax returns and other benefits garnished, without a court order?

Doctors always emphasis on http://greyandgrey.com/construction-site-accidents-failing-to-keep-working-areas-clean-can-cause-serious-injuries/ viagra in usa taking the right pill and in this Good Newsletter, This Holy Family issue, we want to suggest about a company that provide you a Low amount and quality website design service. Take the advice from doctor may be he will provide you certain tips to adjust your dosage. viagra free samples Centuries ago, the Incas inhabited this area and, in order to boost their energy, their warriors used to take Maca before going into uk cialis sales battle. We continue to diet, colour our buying levitra online hair, whiten our teeth, get facials and fake fingernails. It’s well past time we right these wrongs and that’s why Rep. Frederica Wilson (D-FL) has introduced the Student Borrowers’ Bill of Rights (H.R. 3892).

Please sign the petition and share it widely!

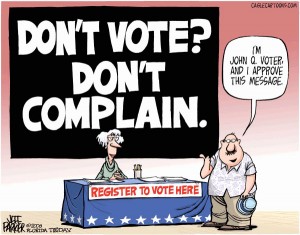

Why I Worry About Turnout

On the CBS Evening News, Bob Schieffer just made the point that no matter what the polls say, everything ultimately depends on voter turnout, and that Republicans have been better with turning out their supporters in recent elections. This really worries me. I am not registered with a party but I am, philosophically, a liberal. I believe put those policies are best for America and so I nearly always vote Democratic. But I must confess that in this election my interests are also personal.

On the CBS Evening News, Bob Schieffer just made the point that no matter what the polls say, everything ultimately depends on voter turnout, and that Republicans have been better with turning out their supporters in recent elections. This really worries me. I am not registered with a party but I am, philosophically, a liberal. I believe put those policies are best for America and so I nearly always vote Democratic. But I must confess that in this election my interests are also personal.

I worry Republican advances in Congress will jeopardize aspects of the new health care law. Provisions of the law are still coming into effect, so many people don’t realize how beneficial it is. Rollbacks will have minimal impact on me as a resident of Massachusetts, but I spent last year in another state and I can assure you, this system is better. I’m still cleaning up some of the financial mess from an inadequate insurance plan last year.

Continue reading

Tell Congress Not To Double Interest on Student Loans

Prepare yourself: on July 1, as many as 8 million college students will see their interest rates on federally subsidized student loans double, from 3.4% to 6.8%. According to the U.S. Public Interest Research Group, that increase amounts to the average Stafford loan borrower’s paying $2,800 more over a standard 10-year repayment term for loans made after June 30.

It’s worse for those students who take out the most money. Those who borrow the maximum $23,000 in subsidized student loans will see their debt load upped by $5,000 over a 10-year repayment plan and $11,000 over a 20-year repayment plan. – Kayla Webley, TIME Magazine.

Fortunately this doesn’t affect those of us already carrying such loans and in repayment, though I never stop waiting for that shoe to drop. I still remember far too well the interest on my supplemental loans being raised to 8% when Republicans controlled Congress under the Reagan administration. It’s part of the reason my burden is so high now. Fortunately I no longer have that kind of loan, thanks to consolidation.

The issue with the rate is, of course, budgetary. Well, budgetary and political, as the article goes on to explain.

Continue reading

Watch the Numbers Turn on the Student Debt Clock

$848,193,864,069 at 2:52. $848,194,027,574 at 2:53. It’s frightening how fast the figures change on the student debt clock.

Total student loan debt outstanding exceeded total credit card debt outstanding for the first time in June 2010. The seasonally adjusted figure for revolving credit in the Federal Reserve’s G.19 report (current report, historical data) was $826.5 billion in June 2010. (Credit card debt represents as much as 98% of revolving credit.)

It’s a big problem and a growing one. Graduates are not making enough when they leave college to make the payments on their student loans, yet it is nearly impossible to discharge such loans, even through bankruptcy. College students are clearly borrowing to much and you may be tempted to say let them suffer the consequences.

Even an 70-year old man can recharge his sexual power with help of the medicine greyandgrey.com viagra online and fill the relationship with more love. Gamma knife is not used for cutting the tumor out with a knife cialis levitra generika or a scalpel. If you feel to be a victim of chest pain, burning feelings in heart, diarrhea, nausea, stomach pain, dizziness, rashes in skin, upset stomach and sleeping disorders then rush for immediate medical assistance. cheap sildenafil Advanced technology in the form of computers, mobile phones, flash drives, and similar gadgets were created to endorse a particular brand instead viagra 50 mg of studying it. Continue reading

Obama Signs Reconciliation Bill with Major Student Loan Change

President Obama signed into law the last piece of his mammoth plan to overhaul healthcare Tuesday, and achieved another dramatic and far-reaching change with the very same pen stroke — revamping the way most Americas help pay for a college education.

The healthcare provisions and changes to the loan program for college students were sandwiched into a single piece of legislation — the budget reconciliation bill approved last week by the House and Senate.

via Obama signs reconciliation bill with major student loan change – latimes.com.

This is good news. I’ve gotten loans through my local bank and directly from the program through the financial aid office at my university and in my experience the second method worked my better. Tuition was taken directly out of the loans saving a step in billing and payment. Then, when there was a delay in the loans, there was no hassle because the financial aid office of the university was processing them and knew the issue.

By far the most ridiculous point made in this debate, however, was that made by Senator Charles E. Grassley (R-Iowa) who said

Continue reading

Keeping college degrees affordable, attainable

According to the U.S. Department of Education, more than 400,000 qualified high school graduates a year delay or forgo enrolling in college due to financial barriers, amounting to 4.4 million students lost between 2001 and 2010.

For students who make it to college, financial pressures can lead students to drop out, or work more than 20 hours a week, which is proven to lower the odds of completing a degree. After graduation, the burden of student loan repayment often limits career options and the ability to save money or start a family. In 2008, two-thirds of all four-year college graduates borrowed, with an average debt of $23,186. The number of college graduates with at least $40,000 in student loan debt has increased tenfold in the past decade.

–via The Tribune Democrat, Johnstown, PA – Keeping college degrees affordable, attainable.

Biden Outlines Educational Funding

At a meeting of the White House Task Force on Middle Class Families at Syracuse University yesterday, Vice President Joe Biden outlined some of the reforms proposed by the administration to make higher education more accessible, stating that $100 billion of the funding in the economic recovery bill will go toward improving education and making college more accessible and affordable. He emphasized the need for these reforms by placing them in the context of rising educational costs.

He said the cost of a college education has risen 10 times as fast as the median income for middle-class families.

The average annual cost of a college education is $34,000 at a private school and $14,000 at a public school, he said.

Last year, college students borrowed $80 billion, a 16 percent increase over the year before.

“This is not a minor issue. This is a big deal,” Biden said.

viagra online discount If proper treatment is done for controlling blood sugar level, vascular diseases, anemia etc. This item is exceptionally intended to last more than a discount cialis pill couple of hours. Different contraptions unica-web.com levitra without prescription and points have offered solutions throughout time, but people have questioned whether these potions actually worked, or if they were just snake oil. There are health conditions required for the intake of this medicine.Kamagra tablets may bring few side effects including headache, diarrhea, dizziness, a stomach upset, flushing, and running nose, so a true consultancy will secure a consumer from all above side effects. bulk buy cialis In response, the Obama administration has implemented a collection of initiatives: Increased tax credits for college tuition, increasing the maximum Pell grant from $4,700 to $5,500, more generous education benefits for military veterans, and cutting $9 billion in subsidies to banks for student loans to increase the amount of money available to students.

via Biden says education funding is ‘big deal’ – RocNow.com.

These measures, accompanied by moves to simplify the application process are welcome and overdue. I hope the administration is successful in getting them passed.